New Tax Bracket 2025 By IRS: The IRS revealed its updated tax brackets for 2025 on Tuesday, showing a 2.8% increase in income thresholds from 2024. This is the smallest rise in several years. Each fall, the IRS announces these inflation-adjusted changes for the next tax year. Due to pandemic-related inflation, previous adjustments were larger, hitting 7% in 2023 and 5.4% this year. The purpose of these adjustments is to prevent “bracket creep,” which happens when inflation pushes taxpayers into higher tax brackets without an actual increase in their living standards.

Alex Durante, an economist at the Tax Foundation, explained that this occurs when inflation, not real income growth, forces people into higher tax brackets or diminishes the value of their credits and deductions. With U.S. inflation now at its lowest in three years, the IRS adjustments are also smaller.

New Tax Bracket 2025 By IRS

For example, the 10% tax bracket threshold for married couples filing jointly will increase to $23,850 in 2025, up from $23,200 in 2024. This new information allows taxpayers to plan their finances more effectively for the upcoming tax year, with returns due in early 2026. The IRS has also updated the federal income tax brackets and standard deductions for 2025, raising the income limits for each bracket.

The highest tax rate of 37% will apply to individuals earning over $626,350 and married couples filing jointly with incomes of $751,600 or more in 2025. Additionally, the IRS adjusted figures for various other provisions, including long-term capital gains brackets and estate tax exemptions.

New 2025 Tax Brackets: Single Filers and Married Couples Filing Jointly

| New 2025 Tax Brackets: Single Filers and Married Couples Filing Jointly | ||

| Tax Rate | Taxable Income (Single) | Taxable Income (Married Filing Jointly) |

| 10% | Not over $11,925 | Not over $23,850 |

| 12% | Over $11,925 but not over $48,475 | Over $23,850 but not over $96,,950 |

| 22% | Over $103,350 but not over $197,300 | Over $96,950 but not over $206,700 |

| 24% | Over $197,300 but not over $250,525 | Over $206,700 but not over $394,600 |

| 32% | Over $250,525 but not over $626,350 | Over $394,600 but not over $501,050 |

| 35% | Over $250,525 but not over $626,350 | Over $501,050 but not over $751,600 |

| 37% | Over $626,350 | Over $751,600 |

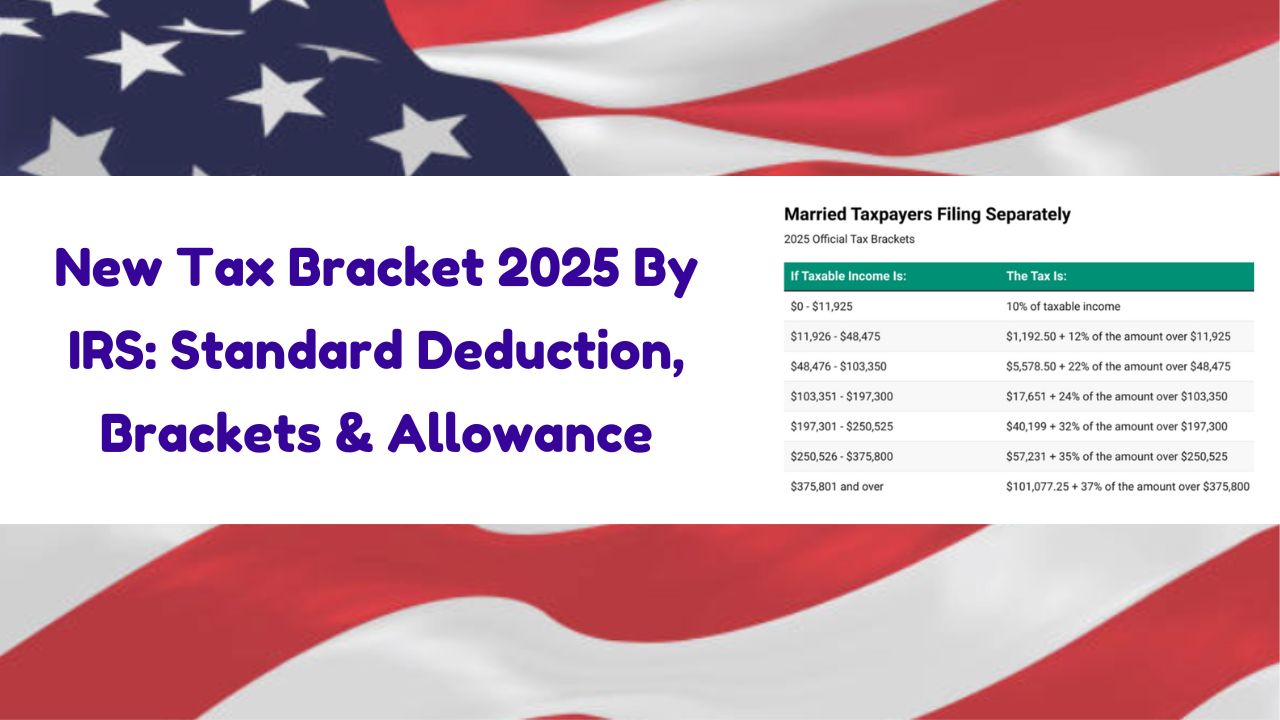

New 2025 Tax Brackets: Married Couples Filing Separately and Head of Household Filers

| New 2025 Tax Brackets: Married Couples Filing Separately and Head of Household Filers | ||

| Tax Rate | Taxable Income (Married Filing Separately) | Taxable Income (Head of Household)) |

| 10% | Not over $11,925 | Not over $17,000 |

| 12% | Over $11,925 but not over $48,475 | Over $17,000 but not over $64,850 |

| 22% | Over $48,475 but not over $103,350 | Over $64,850 but not over $103,350 |

| 24% | Over $103,350 but not over $197,300 | Over $103,350 but not over $197,300 |

| 32% | Over $197,300 but not over $250,525 | Over $197,300 but not over $250,500 |

| 35% | Over $250,525 but not over $375,800 | Over $250,500 but not over $626,350 |

| 37% | Over $375,800 | Over $626,350 |

[Live] SSC CGL Result 2024: Download Tier 1 Merit List, Cut Off Marks @ ssc.nic.in

Measure 118 Payment Benefits, Eligibility & Complete Details

SBI Clerk 1st Waiting List 2024 (Out): Download SBI Clerk Cut Off PDF & Selection Process

How does tax bracket operate?

- Tax brackets in the U.S. mean higher rates for higher earnings.

- Many think their highest tax rate applies to all their income, which is incorrect.

- Each income portion is taxed at different rates based on the brackets.

- For example, a married couple filing jointly pays 10% on the first $23,850.

- They may pay 12% on income over that, but deductions can lower their actual tax owed.

New v/s Old

- The 2025 tax brackets are different from those in 2024 due to inflation.

- High inflation affects the range of tax brackets, making them wider.

- Wider brackets mean there is a larger gap between the lowest and highest income levels.

- This change helps avoid “bracket creep,” where people move to higher tax brackets without an actual increase in real income.

- Expanding brackets lowers the chance of being taxed at a higher rate if income stays the same or grows slowly.

Modified Deductions for 2025

- In 2025, the standard deduction will increase to $30,000 for married couples filing jointly, up from $29,200 this year.

- Single filers and married couples filing separately will see their deduction rise to $15,000, compared to $14,600 currently.

- The standard deduction helps lower taxable income and is used by most taxpayers, as noted by the Tax Policy Center.

- For example, a married couple with a $100,000 income can reduce their taxable income to $70,000 using the 2025 standard deduction.

- Many taxpayers choose the standard deduction over itemizing, as their deductions are often not high enough to surpass it.

Fact Check About $3284 Stimulus Checks 2024: Apply for Alaska PFD, Eligibility & Payment Date

Australia Allowance Payment $987.70 in October 2024- Fact Check & Complete Details

New capital gain Limit for 2025

- The IRS updates capital gains tax thresholds for inflation every year.

- In 2025, low-income and some middle-income taxpayers can pay a 0% tax rate on appreciated assets.

- Individuals earning up to $48,350 will qualify for the 0% rate.

- Single filers making between $48,350 and $533,400 will face a 15% tax rate.

- Married couples earning between $96,700 and $600,050 will also pay 15%, with higher earners facing a 20% rate.

Effects on Estate Tax and Tax free gift

- The estate tax threshold will increase to $13.99 million in 2025, up from $13.61 million in 2024.

- The IRS has announced a rise in the annual limit for tax-free gifts in 2025.

- Individuals can give up to $19,000 to each beneficiary without tax, compared to $18,000 in 2024.

- The federal estate tax exclusion amount will rise next year, allowing more assets to be exempt from tax.

- In 2025, the new gift limit will provide more flexibility for tax-free giving.